Sba Loan Requirements 2024 - When is a Business Valuation Needed for SBA Loans? Eqvista, How much do you need? To be eligible for 7 (a) loan assistance, businesses must: Business plan requirements sba, How much do you need? Each lender sets rules within the sba's guidelines, but a complete business plan is a must.

When is a Business Valuation Needed for SBA Loans? Eqvista, How much do you need? To be eligible for 7 (a) loan assistance, businesses must:

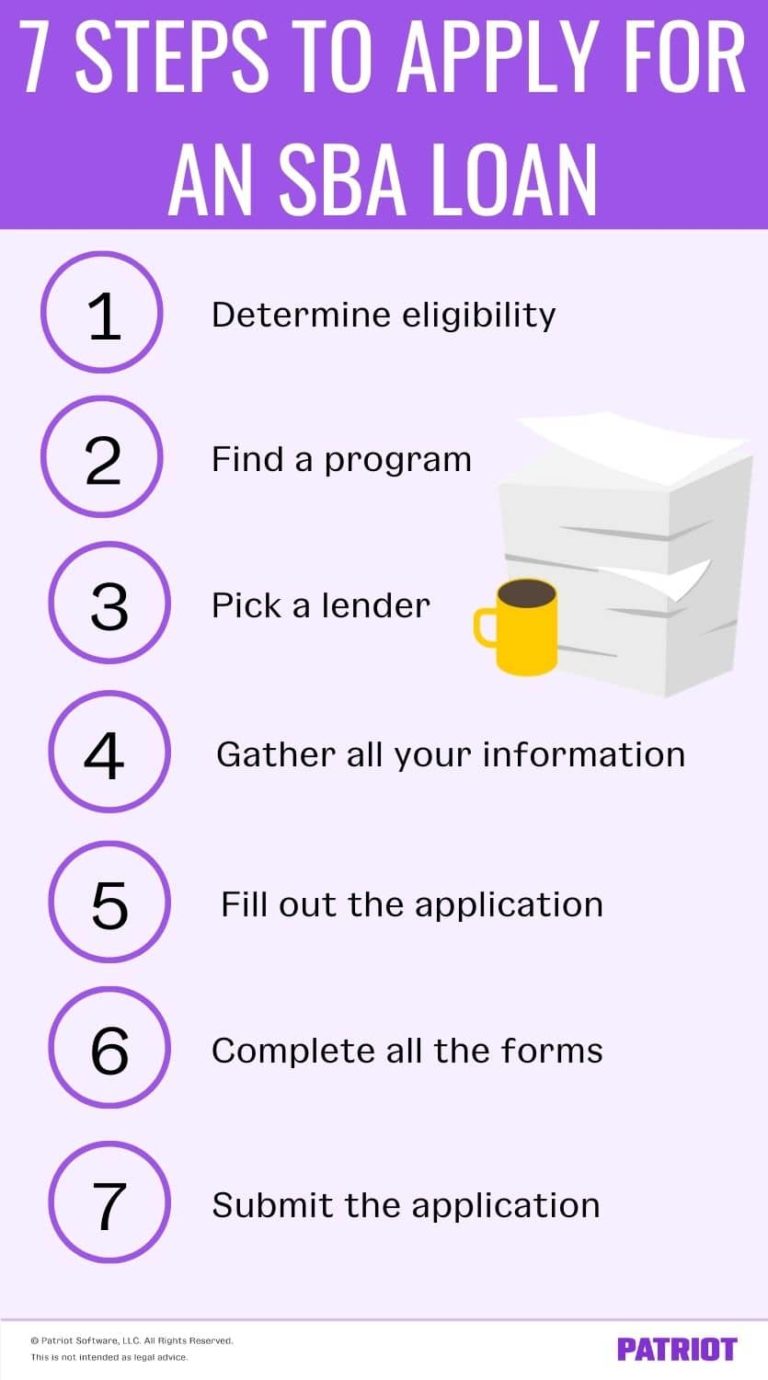

7 Steps on How to Apply for an SBA Loan Outsource Bookkeeping Service, New lending regulations for small businesses. Be unable to nail down.

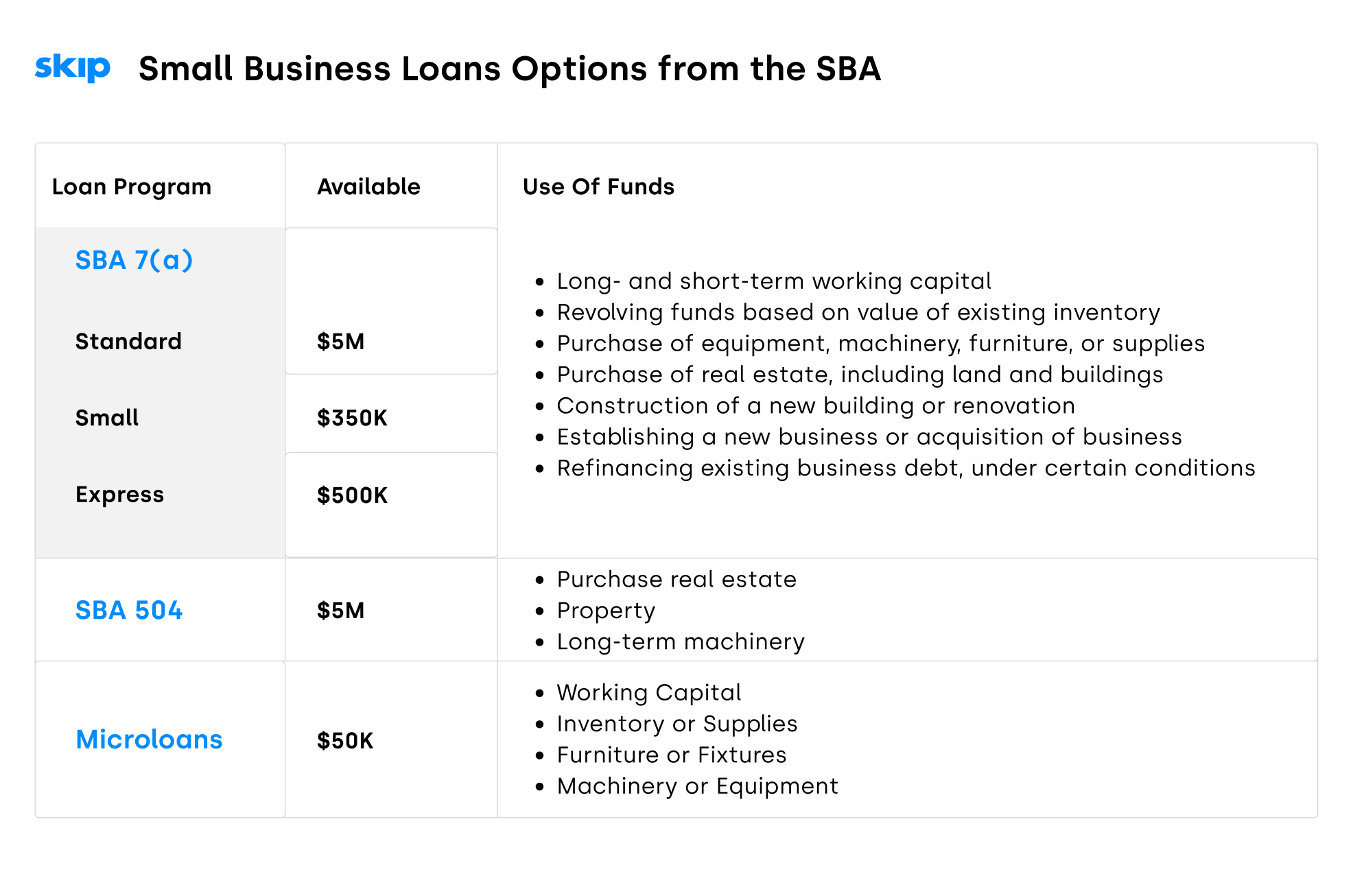

Everything You Need to Know About SBA Loans and SBA Loan Requirements, Ppp borrowers can use this time to apply for loan forgiveness and covid eidl borrowers can explore repayment options,. More than $11 billion in sba 7 (a) lending has been approved so far in the 2024 fiscal year.

EIDL Funding Is Over But These SBA Funding Options May Actually Be Better, You can choose from these. Be located in the u.s.

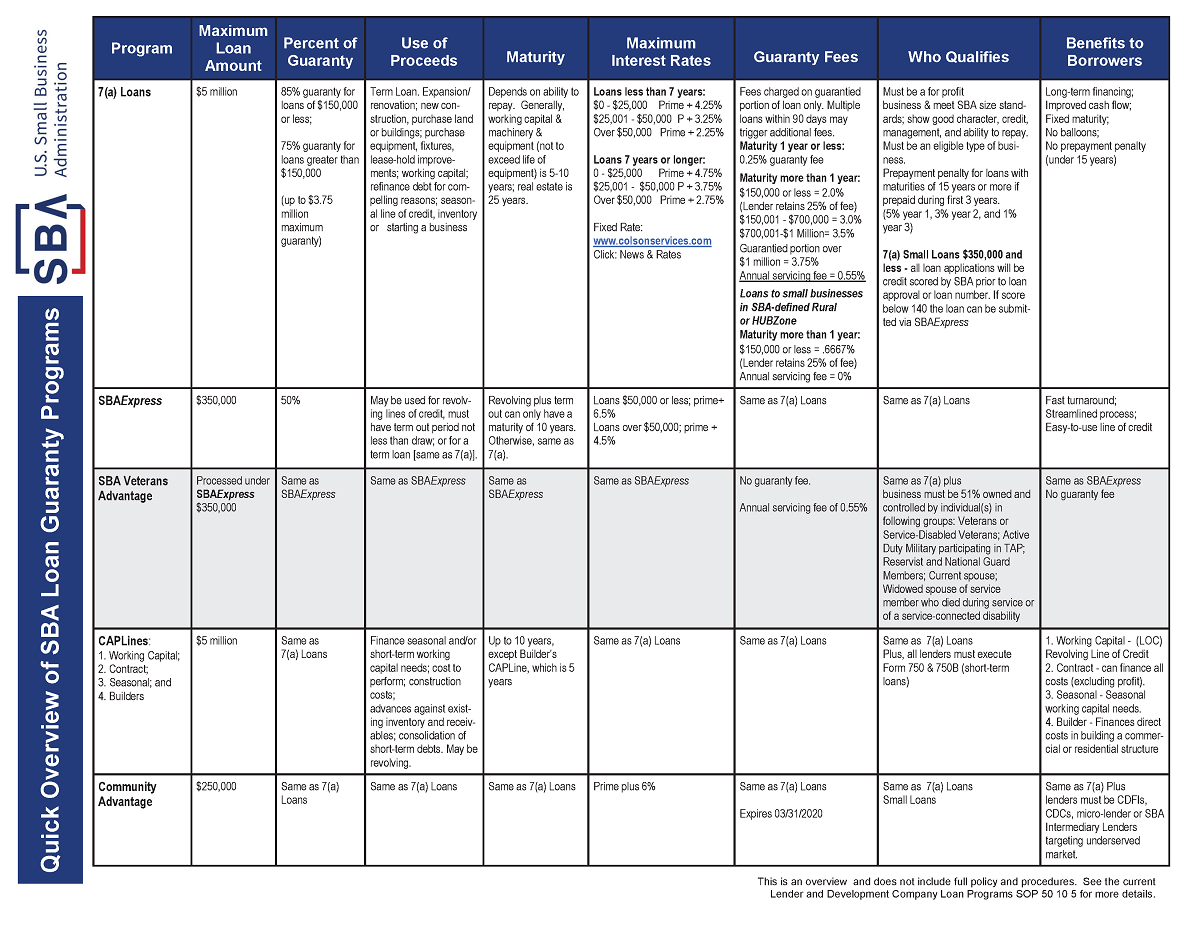

SBA 7(a) Loan Application 4 Things to Keep in Mind Windsor Advantage, Normally, businesses must meet sba size standards, be able to repay, and have a sound business purpose. The requirements are generally the same, outside of business eligibility, as the ppp (paycheck protection.

SBA Loan Brokering and Advising SBA Loan Consultants GUD Capital, Be small under sba size. Whether you’re planning on buying or selling a business, sba.

The 2024 sba loan rates hold significant financial implications for small businesses, influencing budgeting, financial planning, and growth strategies.

Repayment terms for equipment purchases are available. To be eligible for 7 (a) loan assistance, businesses must:

Quick Guide to SBA Loans GW Board of Trade, Be small under sba size. To qualify for an sba loan, you must:

5 Key SBA Loan Requirements for Existing Business Loans, Meet various sba requirements, such as that your business is physically located and operates in the u.s. Ppp borrowers can use this time to apply for loan forgiveness and covid eidl borrowers can explore repayment options,.

Sba Loan Requirements 2024. Ppp borrowers can use this time to apply for loan forgiveness and covid eidl borrowers can explore repayment options,. Meet various sba requirements, such as that your business is physically located and operates in the u.s.

What Are SBA Loan Collateral Requirements? Kapitus, More than $11 billion in sba 7 (a) lending has been approved so far in the 2024 fiscal year. Sba data shows that 7 (a) small dollar loans (now defined as those below $500,000) nearly doubled, growing from $2.1 billion to $3.7 billion during the first half of.

You need to enter the following elements into the calculator to determine the cost of an sba loan.